《中国稀土市场一周报告》2021年第18期

挂牌价

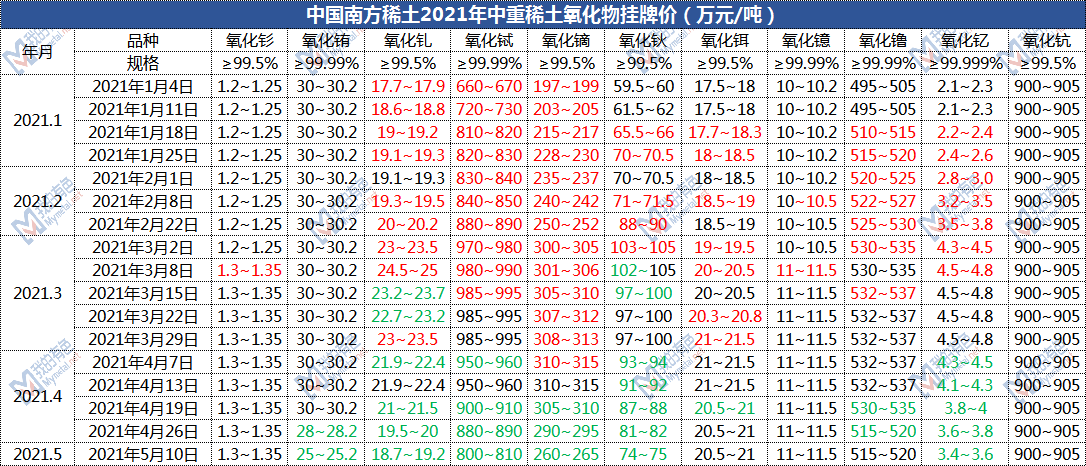

表1:中国南方稀土2021年中重稀土氧化物挂牌价(万元/吨)

数据来源:南方稀土

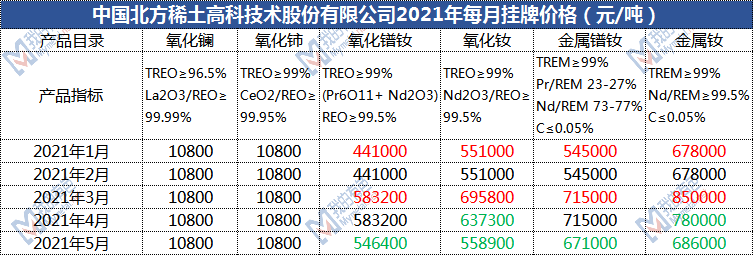

表2:中国北方稀土高科技术股份有限公司2021年挂牌价(元/吨)

数据来源:北方稀土

稀土市场评述

本周稀土市场主流产品整体报货不多,氧化物整体价格偏弱运行,镨钕氧化物报出较少,分离厂挺价意愿不高,贸易商低价报货为主;中重稀土镝铽钆钬价格持续弱稳震荡,金属报价对应调整但成交不多,磁材对锁少量采购观望为主。

This week, there are not many mainstream products in the rare earth market, the overall price of oxides is weak, and there are fewer reports of praseodymium and neodymium oxide. The separation plant is not willing to bid for the price, and traders mainly submit low prices; medium and heavy rare earth dysprosium The price of terbium, gadolinium and holmium continued to fluctuate weakly and steadily. Metal quotations were adjusted accordingly, but there were not many transactions. Magnetic materials mainly wait and see for small purchases of locks.

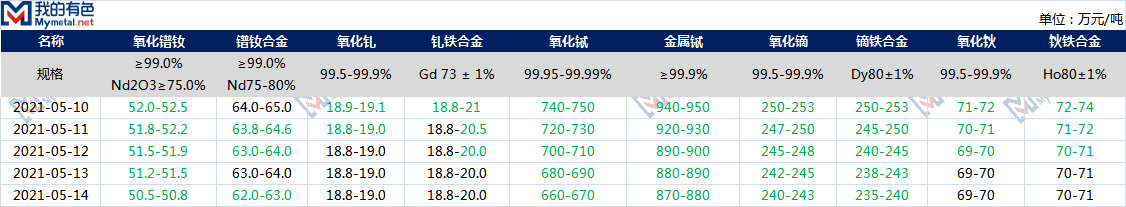

市场报价

数据来源:我的有色

市场成交

数据来源:我的有色

市场分析

轻稀土

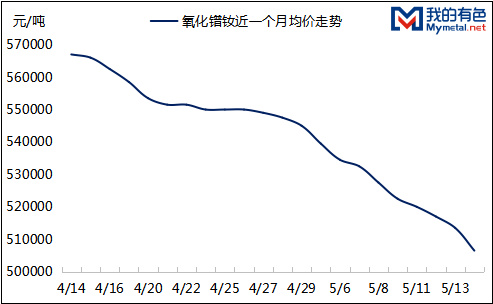

本周轻稀土市场镨钕价格整体偏弱延续,上游分离厂家报价较犹豫,低价出货意愿较低,贸易商少量低价货源变现成交,氧化物价格随市下行,金属厂询盘尚可,寻低少量试探性采购,金属报价对应氧化物下调,磁材询盘问价较活跃,实际成交仍未及预期。截至本周五,氧化镨钕主要报50.8-51.0万元/吨,主要成交50.5-50.8万元/吨,50.5万元/吨及以上成交承压,金属厂采购较犹豫观望为主,市场成交较少。镨钕金属方面,金属大厂报价较少,月结大厂主要报价63.0-63.5万元/吨,主要成交区间62.5-63.0万元/吨,63.0万元/吨及以上成交承压,现款现货主要报62.8-63.0万元/吨,主要成交62.0万元/吨左右,磁材仍降库观望为主,少量对锁。综合来看:目前上游分离厂主动报价意愿不高,贸易商低价少量出货为主,金属厂金属价格持续倒挂,整体成交偏难,磁材当前补库意愿较低,上下游僵持依旧,市场逐步向买方过渡,预计镨钕价格弱稳震荡延续。

The price of praseodymium and neodymium in the light rare earth market continued to be weak this week. The upstream separation manufacturers were more hesitant to offer prices, and the willingness to ship at low prices was low. Traders realized transactions with a small amount of low-priced sources. The price of oxides declined with the market. Inquiries from metal factories are still acceptable. , Looking for a small amount of tentative purchases, metal quotations are lowered corresponding to oxides, magnetic material inquiry prices are more active, and the actual transaction is still not as expected. As of this Friday, praseodymium oxide and neodymium oxide were mainly reported at 508,000-510 thousand yuan/ton, the main transaction was 505,000-508,000 yuan/ton, and the transaction of 505,000 yuan/ton and above was under pressure. Metal factories were more hesitant to wait and see, and market transactions less. Regarding praseodymium and neodymium metals, major metal manufacturers offer fewer prices. The monthly prices of major manufacturers are 630-63.5 million yuan/ton, and the main transaction range is 625-63.0 million yuan/ton. The transactions of 63 million yuan/ton and above are under pressure, and cash is on spot. Mainly reported at 62.8-63.0 million yuan/ton, and the main transaction was about 62 million yuan/ton. Magnetic materials are still down the warehouse and wait and see, with a small amount of locks. On the whole: At present, upstream separation plants are not willing to take the initiative to offer prices, traders mainly sell small quantities at low prices, metal prices continue to fall in metal plants, the overall transaction is difficult, the current willingness of magnetic materials to replenish inventory is low, and the upstream and downstream stalemate remains. The market is gradually transitioning to buyers, and the price of NdPr is expected to continue to fluctuate weakly and steadily.

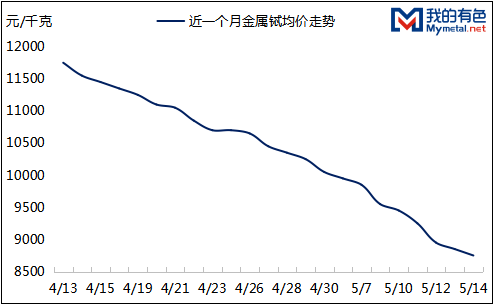

图1:2021.4.14-5.14氧化镨钕均价走势图

数据来源:我的有色

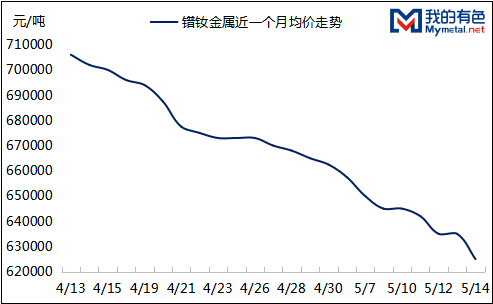

图2:2021.4.14-5.14镨钕金属均价走势图

数据来源:我的有色

重稀土

本周中重稀土主要产品市场整体报价弱稳震荡,分离厂家报价减少先观望,贸易商少量货源低价变现,金属厂刚需采购,镝铁、铽等金属产品报价随氧化物下探以促进成交,下游磁材询盘活跃度偏淡,成交量未及预期。截至本周五,氧化镝成交区间240-242万元/吨,237-240万元/吨个别成交,金属厂采购意愿不高;镝铁报价较少,金属厂 报价主流238-242万元/吨,235-240万元/吨个别成交;氧化铽贸易商报货居多,部分分离企业暂无报价,650万元/吨及以内贸易商少量变现,分离厂家报价坚挺660-680万元/吨,集团持谨慎观望态度,金属企业金属铽主动报价较少,报价区间860-880万元/吨,磁材询低刚需采购成交承压,850万元/吨个别成交;氧化钆市场询盘增加,18.8-19.0万元/吨少量成交,金属厂18.8万元/吨及以内询低为主,钆铁一次现款对应18.8万元/吨个别成交;氧化钬询盘活跃度较低,分离厂报货坚挺,中间商少量货源变现,现款成交区间70.0万元/吨左右,个别70万以上成交,金属企业钬铁报价较少,冶炼企业炉台减停,现货一次现款对应报71.0万元/吨左右。现阶段中重稀土仍是以消费定走势为主,消费方面暂无利好支撑,主要产品将弱稳延续。

In this week, the overall quotation of the main products of heavy rare earths in the market was weak and stable. Separate manufacturers’ quotations decreased and wait and see. Traders realized a small amount of supply at low prices. Metal factories just needed to purchase. The quotations of metal products such as dysprosium and terbium dropped along with oxides to promote transactions. Inquiry activity for magnetic materials was weak, and the transaction volume fell short of expectations. As of this Friday, the transaction range of dysprosium oxide was 2.4-242 million yuan/ton, and individual transactions were 2.37-2.4 million yuan/ton. The willingness of metal factories to purchase is not high; dysprosium iron offers less, and metal factories offer mainstream 2.38-2.42 million yuan/ Tons, 2.35-2.4 million yuan/ton were sold individually; most of the terbium oxide traders reported goods, and some separation companies had no quotations temporarily. Traders within 6.5 million yuan/ton or less realized a small amount of cash, and the separation manufacturers’ quotations were firm 6.6-6.8 million yuan/ton. , The group is cautious and wait-and-see attitude, metal companies actively offer less metal terbium, the quotation range is 8.6-8.8 million yuan/ton, magnetic material inquiries are low and just need to purchase transactions under pressure, 8.5 million yuan/ton individual transactions; gadolinium oxide market inquiries increase , A small number of transactions of 188,000 to 199,000 yuan/ton, the metal factory’s 188,000 yuan/ton and lower inquiries were the main ones, the one-time cash of gadolinium iron corresponds to an individual transaction of 188,000 yuan/ton; the holmium oxide inquiries were less active, and the separation plant reported The goods were strong, and the intermediary realized a small amount of goods. The cash transaction range was about 700,000 yuan/ton, and some transactions were more than 700,000 yuan. The holmium iron quotation of metal enterprises was less, and the smelting enterprise reduced the number of furnaces. The spot cash was quoted at about 700,000 yuan/ton. . At this stage, medium and heavy rare earths are still dominated by consumption trends, and there is no positive support for consumption for the time being, and the main products will continue to be weak and stable.

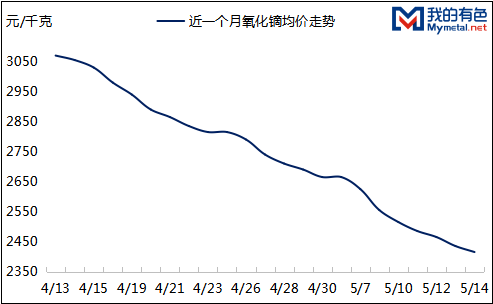

图3:2021.4.14-5.14氧化镝均价走势图

数据来源:我的有色

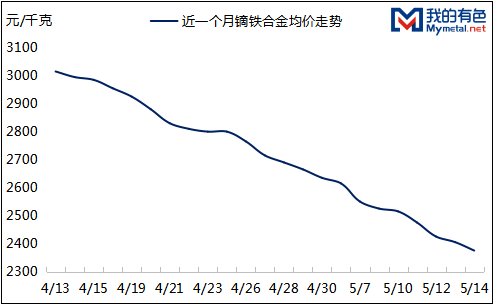

图4:2021.4.14-5.14镝铁合金均价走势图

数据来源:我的有色

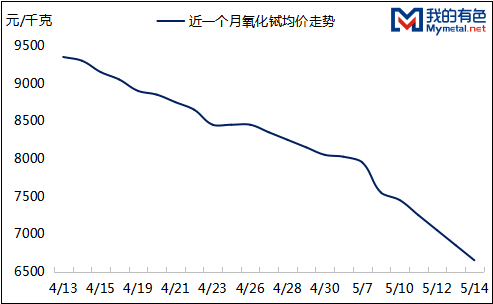

图5:2021.4.14-5.14氧化铽均价走势图

数据来源:我的有色

图6:2021.4.14-5.14金属铽均价走势图

数据来源:我的有色

市场总结

轻稀土镨钕氧化物厂家现货市场主动报价意愿较低,贸易商少量货源低价报出为主,随着氧化物价格持续弱稳震荡趋势,金属价格对应下调成交倒挂,同时氧化物报出不多,金属厂逢低对锁采购,磁材刚需降库为主,上下游僵持依旧,金属成交价格未及预期,市场整体询盘成交偏淡,待下游库存进一步消耗,采购节奏变换,镨钕价格或将由弱稳震荡趋势走稳;中重稀土上游厂家报价犹豫,出货意愿不高,持货商少量货源让利成交,预计镝铽钆钬价格或将延续弱稳震荡。

My non-ferrous network believes that light rare earth Pr and Nd oxide manufacturers are less willing to actively quote in the spot market, and traders mainly report low prices from a small amount of supply. As the price of oxides continues to weakly and steadily fluctuate, the price of metal is corresponding to the downward adjustment and the transaction is upside down. At the same time, there are not many reports of oxides. Metal factories purchase locks on dips. Magnetic materials just need to lower their warehouses. The upstream and downstream stalemate remains. The metal transaction prices are not as expected. The overall market inquiries and transactions are weak. Waiting for the downstream inventory to be further consumed. Purchasing rhythm changes, and the price of praseodymium and neodymium may stabilize from a weak and stable trend; the upstream manufacturers of China and heavy rare earths are hesitant to offer, and the willingness to ship is not high.

来源:我的有色网(Mysteel)

- 上一篇:《中国稀土市场一周报告》2021年第17期 2021/5/19 9:23:43

- 下一篇:《中国稀土市场一周报告》2021年第19期 2021/5/19 9:23:43