《中国稀土市场一周报告》2021年第12期

一、挂牌价

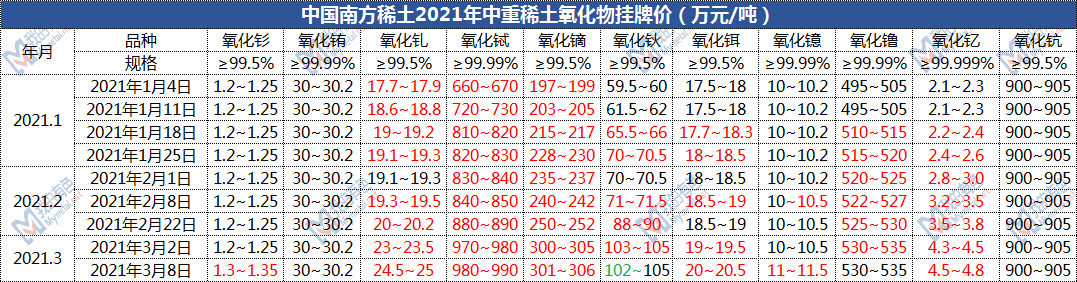

1、南方稀土集团挂牌价

表一 中国南方稀土2021年中重稀土氧化物挂牌价

数据来源:南方稀土

2、北方稀土集团挂牌价

表二 中国北方稀土高科技术股份有限公司2020-2021年每月挂牌价格

数据来源:北方稀土

二、稀土市场

1、中国稀土市场评述

本周稀土市场主流产品整体报价较少,氧化物整体报价偏弱,镨钕氧化物报货量不多,分离厂惜售,贸易商谨慎观望为主;中重稀土镝铽钆钬价格继续稳中偏弱,金属报价对应但成交一般,磁材对锁刚需采购观望为主。

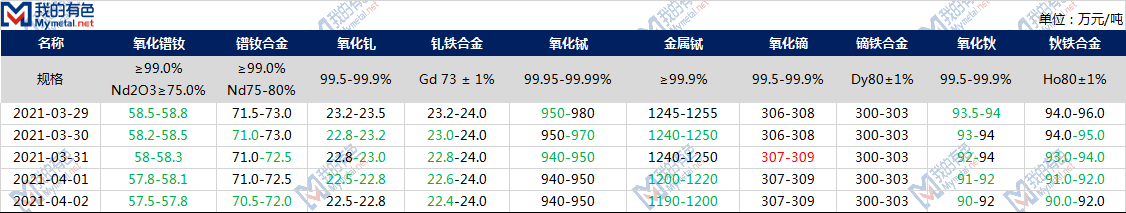

2、市场报价

表三 2021年3月29日-4月02日主流稀土产品报价(万元/吨)

数据来源:我的有色

3、市场成交

表四 2021年3月29日-4月02日主流稀土产品成交情况

数据来源:我的有色

三、市场分析

轻稀土方面:

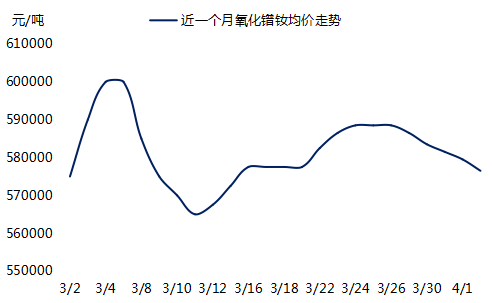

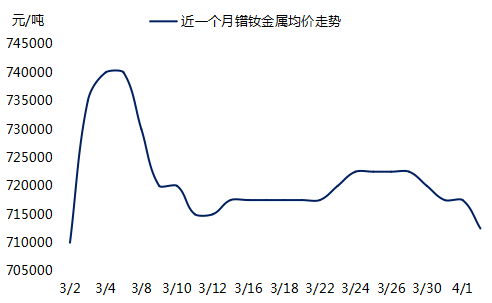

本周稀土市场镨钕价格整体偏弱运行,上游分离厂主动报价意愿不高,中间商少量货源报出变现,金属厂采购较犹豫,刚需对锁为主,市场观望情绪较浓,镨钕金属报价随氧化物小幅下调,磁材整体询盘活跃度不高,降库对锁,镨钕金属成交有待观望。截至本周五,氧化镨钕主要报57.8-58.0万元/吨,主要成交57.5万元/吨左右,57.8万元/吨及以上成交承压,金属厂57.2万元/吨及以内寻低较活跃,货源有限。镨钕金属方面,金属大厂镨钕金属月结大厂主要报价72.0万元/吨左右,主要成交71.8-72.0万元/吨,72.0万元/吨以上成交承压,现款现货主要报71.0万元/吨左右,主要成交70.0-70.5万元/吨,磁材询低少量刚需采购。

另外,赣州地区分离厂减停产,氧化物供应会偏紧,金属厂现货也没有很多,磁材订单也没有听说减少,那从基本面来看镨钕为何掉价呢??磁材下游客户仍不接受磁钢高价??金属厂倒挂由下至上传导价格回调??我的有色网调研了解:从氧化物来看,赣州地区分离厂减停产的直接影响体现时间还未到,反而因为废料厂减停产的消息影响到一部分废料贸易商的心态,以致废料报货增加价格松动,情绪传导至氧化物贸易环节也开始试探性调价变现;另一方面从下至上价格传导,磁材企业毛坯对应接单范围主要仍在68-70万元/吨,前期价格持续上涨毛坯价格在拉涨之后需要时间消化,需要低价库存逐渐被消耗。镨钕金属高价成交承压,金属厂采购自然犹豫,寻低对锁为主,贸易商也有受到这方面情绪作用试探报货。

从金属来看,金属厂现款采购氧化物,然而金属大多以账期或含承兑模式交易,回款需要1-3个月时间,在资金流动层面就需要金属厂垫入,且现阶段保证炉台正常冶炼原材料成本比之前要多,资金压力更大,采购氧化物时更为谨慎亦是理所当然。

时间再推后,赣州地区氧化镨钕供应偏紧更明显,金属厂、磁材库存进一步消耗,或一定程度支撑镨钕价格,因此我们预测节后镨钕或将出现区间小幅偏强震荡行情,但受到牵制僵持上行仍有压力。

This week, the price of praseodymium and neodymium in the rare earth market is generally weak. The upstream separation plant is not willing to actively quote, and the intermediary has reported a small amount of supply to realize cash. The metal factory is hesitant to purchase, and the market is mainly for locks. The market has a strong wait-and-see sentiment. The quotation was slightly lowered along with the oxide, the overall enquiry activity of magnetic materials was not high, and the inventory was reduced to lock, and the transaction of praseodymium and neodymium metal remains to be seen. As of this Friday, praseodymium oxide and neodymium oxide were mainly reported at 578,000 to 580,000 yuan/ton, the main transaction was about 575,000 yuan/ton, the transaction of 578,000 yuan/ton and above was under pressure, and the metal factory was looking for a lower price within 572,000 yuan/ton. Active, limited supply. Regarding praseodymium and neodymium metals, major metal manufacturers praseodymium and neodymium metal month-end manufacturers mainly quoted at around 720,000 yuan/ton, and the main transaction was 718-700,000 yuan/ton. The transactions above 720,000 yuan/ton were under pressure, and the cash spot price was mainly 710 thousand. Around RMB/ton, the main transaction was RMB 70-705,000/ton, and a small amount of magnetic materials was inquired and just needed to be purchased.

In addition, the separation plant in Ganzhou region cuts and suspends production, the supply of oxides will be tight, the metal plant does not have a lot of stock, and the order for magnetic materials has not been heard to decrease. Then from a fundamental point of view, why does the price of NdPr fall? ? Downstream customers of magnetic materials still do not accept the high price of magnetic steel? ? Metal factories upside down to conduct price callbacks from bottom to top? ? My non-ferrous network research and understanding: From the perspective of oxides, the direct impact of the reduction and shutdown of the separation plant in Ganzhou has not yet come. On the contrary, the news of the reduction and shutdown of the waste plant has affected the mentality of some scrap traders, resulting in an increase in scrap declarations. The price loosened, sentiment was transmitted to the oxide trade link and began to tentatively adjust the price to realize; on the other hand, the price transmission from bottom to top, the range of corresponding orders for magnetic materials enterprises was still 680-700,000 yuan/ton, and the previous price continued to rise. After the price rises, it will take time to digest, and low-priced inventory needs to be gradually consumed. The high price of praseodymium and neodymium metal is under pressure, and metal factories naturally hesitate to purchase, mainly looking for low pairs of locks. Traders are also exposed to the emotional effect of this aspect to test their orders.

From the perspective of metals, metal factories purchase oxides in cash. However, most metals are traded in the account period or with acceptance mode. It takes 1-3 months to pay back. At the level of capital flow, the metal factory is required to advance, and the furnace is guaranteed at this stage. The cost of normal smelting of raw materials is higher than before, and the pressure on funds is greater. It is natural to be more cautious when purchasing oxides.

After the time is delayed, the supply of praseodymium and neodymium oxide in Ganzhou is more obvious, and metal factories and magnetic material inventories will be further consumed, which may support the price of praseodymium and neodymium to a certain extent. Therefore, we predict that after the festival, there will be a slight and strong fluctuation in the price of praseodymium and neodymium. However, the upward pressure still remains constrained by the stalemate.

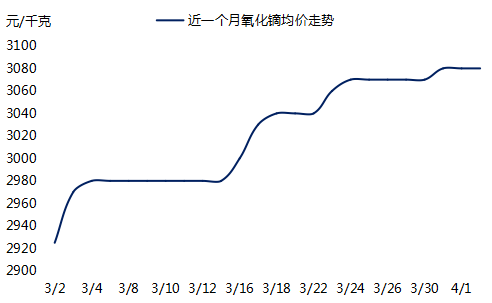

图一 2021年3月02日-4月12日氧化镨钕均价走势

数据来源:我的有色

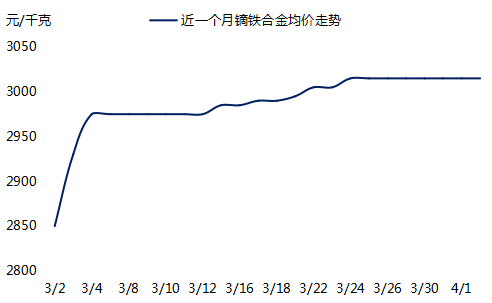

图二 2021年3月02日-4月02日镨钕金属均价走势

数据来源:我的有色

中重稀土方面:

本周中重稀土主要产品整体报价较少,氧化物成交价格弱稳震荡,氧化镝价格较坚挺,目前分离厂观望市场为主,贸易商少量货源报出试探变现,金属厂对锁刚需采购,金属产品报价犹豫,下游磁材询盘活跃度不高,整体成交未及预期。截至本周五。氧化镝成交区间307-309万元/吨,309万元/吨以上成交承压,镝铁报价持稳,300-303万元/吨少量成交,现款300万元/吨及以上成交承压,磁材询盘活跃度一般,成交量未及预期;氧化铽中间商报货为主,940-950少量成交,分离厂谨慎观望为主,金属厂金属铽报价1190-1200万元/吨对应调整,成交1190-1200万元/吨,整体成交偏少;氧化钆询盘活跃度较低,22.5-22.8万元/吨成交,22.6万元/吨及以上成交承压,钆铁一次现款成交22.4-22.5万元/吨左右,成交较少;氧化钬询盘活跃度低,分离厂报货犹豫,现款成交90.0-92.0万元/吨左右,92.0万元/吨及以上成交承压,金属厂钬铁报价较少,一次现款成交90万元/吨左右,市场成交较少。

The overall quotation of the main products of heavy rare earths in this week is relatively small, the transaction price of oxides is weak and stable, and the price of dysprosium oxide is relatively strong. At present, separation plants mainly wait and see the market. Traders have reported a small amount of supply to try to realize the realization. Metal factories just need to purchase locks. Metal products The quotation was hesitant, the downstream magnetic material inquiries were not active, and the overall transaction fell short of expectations. As of this Friday. The transaction range of dysprosium oxide was 3.0-3.09 million yuan/ton, and transactions above 3.09 million yuan/ton were under pressure. The quotation of dysprosium iron remained stable, with small transactions of 3-3.03 million yuan/ton, and transactions of 3 million yuan/ton and above were under pressure. Magnetic materials are generally active in inquiries, and the transaction volume is less than expected; terbium oxide intermediaries mainly report goods, 940-950 small transactions, separation plants are mainly cautious and wait-and-see, metal plants offer 1.90-12 million yuan/ton for metal terbium and adjust accordingly , The transaction was 1.190-12 million yuan/ton, and the overall transaction was relatively small; the activity of gadolinium oxide inquiries was low, with 225,000-22.8 million yuan/ton transactions, 226,000 yuan/ton and above transactions were under pressure, gadolinium iron one-time cash transaction 22.4 About -225,000 yuan/ton, the transaction is relatively small; the holmium oxide inquiry activity is low, and the separation plant is hesitant to submit the goods. The cash transaction is about 90-92.0 million yuan/ton, and the transaction of 90,000 yuan/ton and above is under pressure. The price of holmium iron is less, and the cash transaction is about 900,000 yuan/ton, and the market transaction is relatively small.

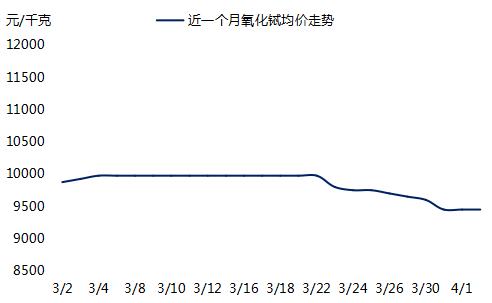

图三 2021年3月02日-4月02日氧化镝均价走势

数据来源:我的有色

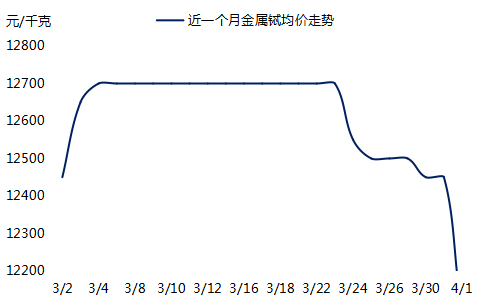

图四 2021年3月02日-4月02日镝铁合金均价走势

数据来源:我的有色

图五 2021年3月02日-4月02日氧化铽均价走势

数据来源:我的有色

图六 2021年3月02日-4月02日金属铽均价走势

数据来源:我的有色

市场总结:

轻稀土镨钕氧化物厂家现货市场报出较少,贸易商少量货源报出变现,随着氧化物价格逐步下探,对应到金属成交或逐渐增加,且氧化物供应愈加偏紧,金属厂逢低对锁采购,金属价格随氧化物调整,磁材刚需采购,金属成交价格未及预期但时间换来空间,待下游库存进一步消耗,采购节奏变换,镨钕价格或将由上至下传导出现区间小幅偏强行情;中重稀土上游厂家报价犹豫,出货意愿不高,持货商少量货源让利成交,预计钆钬铽价格弱稳震荡,镝以稳为主,同时需要关注消息面和政策面动向。

Light rare earth praseodymium and neodymium oxide manufacturers have reported less spot market reports, and traders have reported realizing a small amount of supply. As the price of oxides gradually drops, corresponding to metal transactions or gradually increase, and the supply of oxides is becoming tighter, metal factories Low pair lock purchases, metal prices are adjusted with oxides, magnetic materials just need to be purchased, and metal transaction prices are not as expected but time is exchanged for space. When downstream inventory is further consumed and the purchasing rhythm changes, the price of praseodymium and neodymium may be transmitted from top to bottom. Slightly strong market; China heavy rare earth upstream manufacturers hesitate to offer prices, and the willingness to ship goods is not high. Holders make a small amount of supply to make a profit. It is expected that the price of gadolinium, holmium and terbium will be weak and stable. Dysprosium is mainly stable. At the same time, attention needs to be paid to the news and policy aspects. trend.

来源:我的有色网(Mysteel)

- 上一篇:《中国稀土市场一周报告》2021年第11期 2021/4/7 17:02:12

- 下一篇:《中国稀土市场一周报告》2021年第13期 2021/4/7 17:02:12